Hi, I’m Diana!

PERSONAL FINANCE COACH

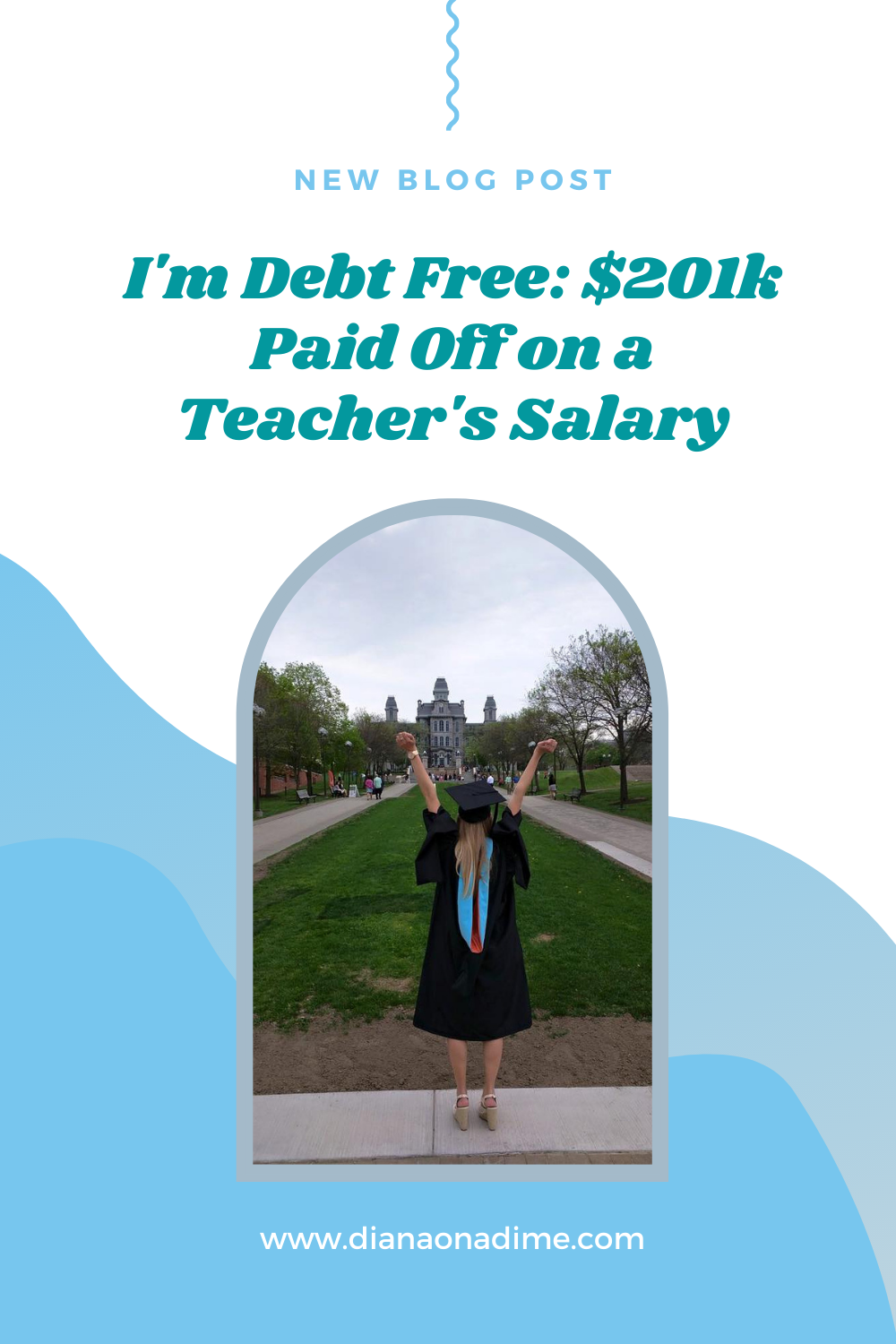

$201k in student loan debt was crippling on a teacher’s salary.

I didn’t know what to do and I had no idea how I was going to afford my monthly expenses on my teacher’s salary. My debt minimum payments were barely covered by my income.

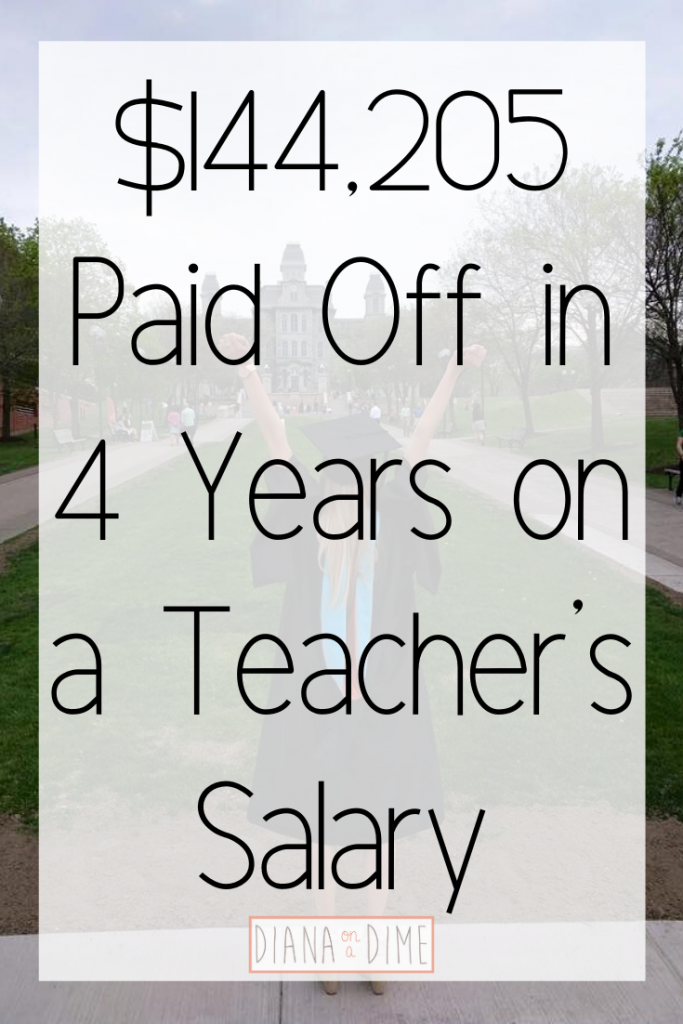

Fast forward 4 years and I’ve paid off 6 figures of debt and increased my income through side hustles. I want to help you do the same for your life.

I’ve had 6 figure debt and no idea what to do. I’ve not made enough money to afford my minimum payments. Now, I’ve paid off 6 figures of debt and comfortably afford my lifestyle and I want to help you do the same for yourself.