Debt Free Update: $124,378 Paid Off!

This post may contain affiliate links. Check out my Disclosure Policy for more information.

I feel crazy typing this, but now that I’ve been on this journey for roughly 3 and a half years, I feel so close to being debt free, even though I have $76,718 left. Maybe that isn’t crazy, but I know I’m no where close to being done, it just seems so much more manageable.

I remember when I hit my financial breaking point and absolutely freaking out about just affording my minimum payment on my teaching salary. Now I’m at the point where it’s no longer a stress in my life.

Of course, I still have about $1,100 as a minimum payment every month, but that’s a lot less than the $2,000 it was when I started. My monthly minimum payment would be $1,000 now, if I didn’t refinance.

Yes, I took about a $100 increase in minimum payment, sounds crazy right? But, this allowed me to get an interest rate of 4.97% instead of 7.05%, totally worth it in the long run.

Refinancing isn’t for anyone, but for me and my student loans, it was something I had been working to do for years. I am so happy to have a lower interest rate because so much more of my payment goes to the principal now. If you are considering refinancing your student loans, check out my post that outlines some questions to ask yourself before doing it!

Debt Free Update: Private Loans

I hate all of my student loans, but especially my private loans. I especially hated them when I had my old provider. I will say, I don’t hate them as much since I refinanced them with Earnest back in September 2018. They are awesome to deal with, listen to feedback and actually make the changes, and I am finally seeing actually movement in my pay off of them.

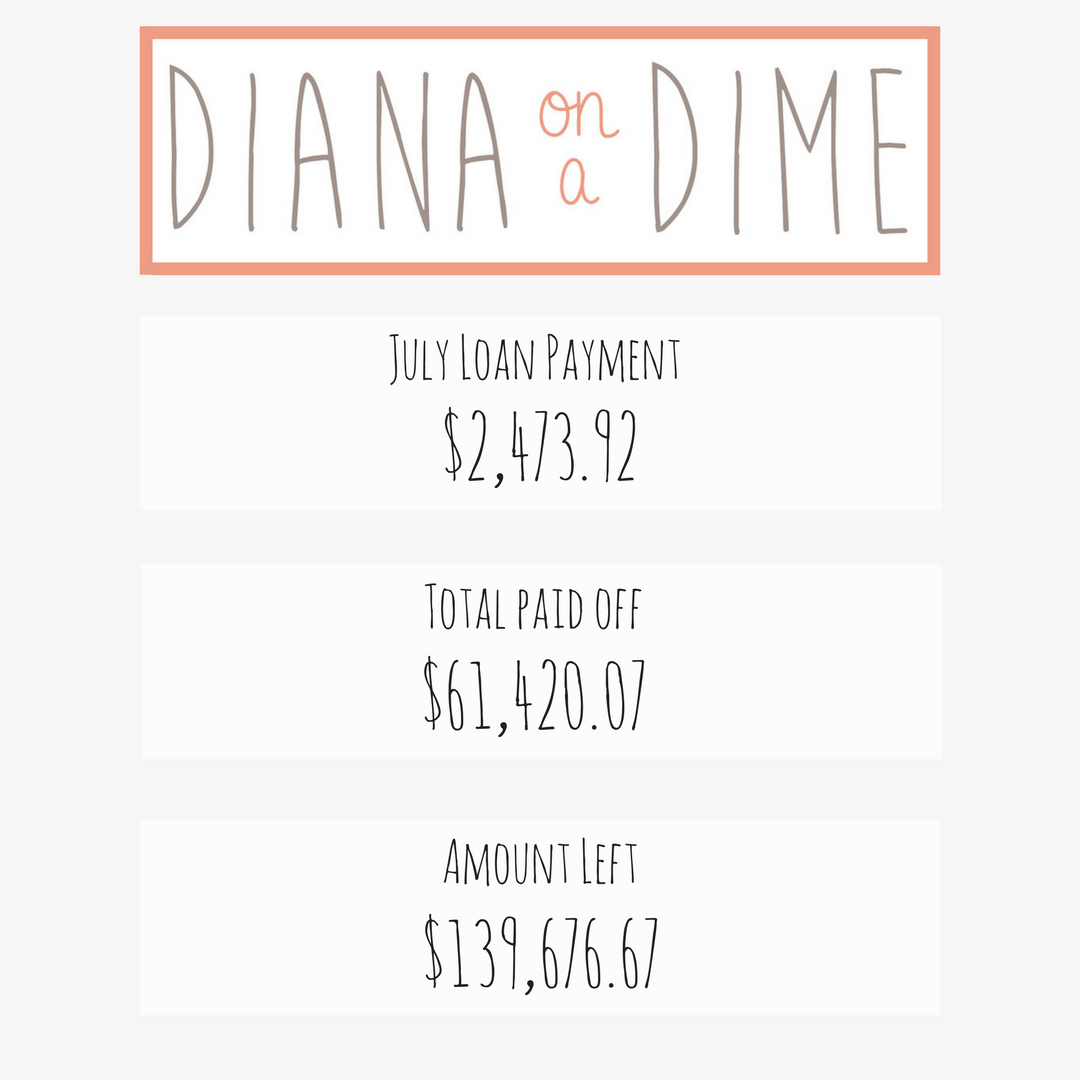

In September 2018, I refinanced $45k of my student loans, which was all of my private student loans. Now, I have $23,981 in private loans, I’ve paid off $21k in 7 months, just in my private student loans! This never would have been possible, if I didn’t refinance my loans, because I was paying so much in interest every month. If you are considering refinancing your student loans, you can use my referral link to get you $200 when you refinance!

Things are very up in the air for the second half of the year for me, my plan is to pay my private loans off by the end of the year. This goal will change depending on how things pan out after June.

Debt Free Update: Federal Loans

My federal loans are still on income driven repayment. I just renewed it and my payment is going up $50 to $300. This is actually a good thing because my loans accrue about that much in interest every month.

While focusing on my private loans, I have been paying the minimums on my federal loans, but making an extra payment every month to make sure the interest is paid off every month. The reason I do this is because I don’t want the unpaid interest to be added to the principal, making the loan increase. This will require me to pay even more in interest and even more in the long run.

This is why it is so important to understand these programs and stop making blind student loan payments. Your payment may be as small as $0 every month, which means your principal is going to increase on your loans. So, yes your loan is in good standing, but you are increasing your principal every single month!

My loan amount doesn’t really change much on my federal loans for now, I’m basically just paying off my interest every month. Right now my federal loans are $52,736. These are broken down in many smaller loans. Once I pay off my private loan, I plan to pay off my federal loans by avalanching the smaller loans based on their interest rate.

Debt Free Plan

I have been going very hard at my goal to pay off this debt as fast as possible. I’ve increased my income, moved back home with my parents, and cut my spending down. Currently, my debt free date is May 2021, which is incredible! It’s amazing what consistent choices over and over can do.

I’m not sure where my debt free journey will go by the end of the year. I have plans to move out, maybe get a new job, I’m okay to slow down my journey a bit to move out of my parents house. I have paid off so much debt, way more than I ever thought would be possible at 26 years old, that I’m okay with it all.

Right now, if I continue with my current plan, I will have just turned 29 when becoming debt free. My goal has always been to have my student loans paid off by my 30th birthday. Right now, I have a nice buffer of time on my side and I feel really good about where I am at with my finances. How is your debt free journey going?